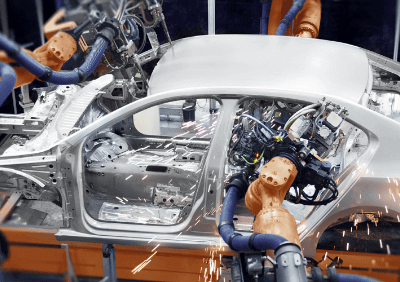

Automotive

Developing lean supply chains with direct cost benefits

Industry overview

Today, the automotive industry is challenged by the surge in upcoming technology trends – EVs, autonomous driving, shared mobility, and the ever-changing emission norms. Automakers need to adopt strategic initiatives to shape the industry’s evolution while still maintaining profit and channels for expansion. For this, the auto players need to make fundamental changes in their supply chain and procurement networks. They need to search for new avenues of efficiency through cost rationalization in production, vertical integration of vendors and adopt tech-led sourcing and procurement models.

The Moglix advantage

Moglix helps its automotive clients implement world-class digital procurement solutions that provide intuitive catalog exploration, detailed spend analytics, real-time order tracking, and integration with ERP, all of which lead to significant cost savings and an increase in overall efficiency.